SAFETY, US ECONOMY TOP OF MIND. With the end of the year fast approaching our Q4 Fleet Manager Sentiment Index shows that while top fleet managers feel much the same about our basket of 7 key indicators, conversations with them are starting to expose some divergence in their thinking and concerns about some of the potentially more critical categories like safety and the US economy, with one of our customer advisors saying the economy “felt like 2008 all over” as tariffs and a long few years of high interest rates have stifled growth. Fleet managers also continue to be negative on talent availability – especially when it comes to drivers – as well as expressing concerns about vehicle service and maintenance, citing rising costs and increased repair times as especially concerning. *On a scale of 1-5 with 5 being most confident. Mouse over any quarter to see its specific chart.

No Data Found

Work Truck Week 2025 saw record attendance and exhibitors, affirming its status as the premier fleet industry event. Tariffs and regulatory uncertainty were major discussion points, while relationship-building took precedence over new tech. Electric vehicle (EV) momentum slowed amid infrastructure concerns, with alternative fuels like hydrogen and propane gaining interest. Major OEMs showcased electric offerings, […]

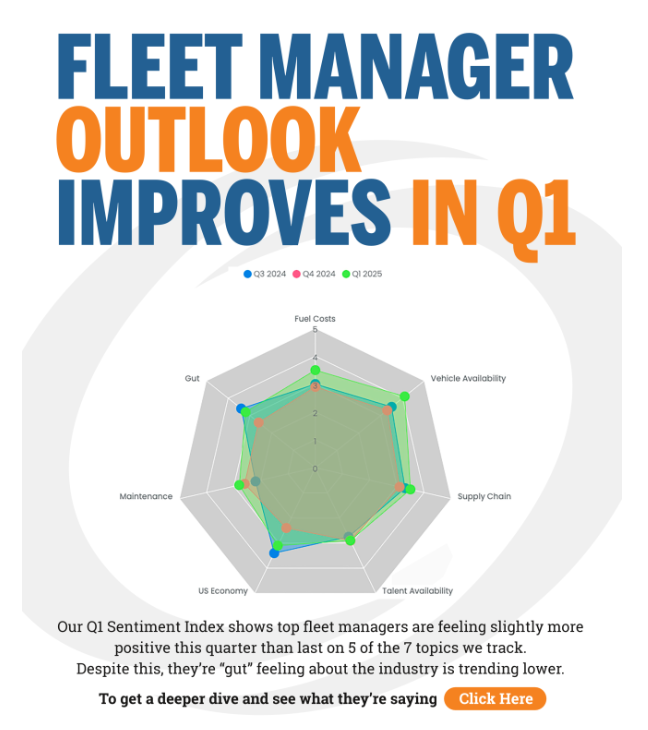

In Q1, fleet managers expressed slightly more confidence across most areas compared to Q4 2024. However, concerns remain. Supply chain disruptions—especially around semiconductors—persist, despite signs of resilience. Vehicle availability is improving, but upfit delays continue. Economic uncertainty, especially for small businesses, and geopolitical tensions are causing caution. Fuel price outlook is modestly optimistic. Overall, many […]

In 2024, the wholesale used vehicle market returned to more “familiar” patterns after years of volatility. Values declined about 15% across most classes, with smaller vehicles holding value better than larger ones. High-mileage, lower-quality units were abundant, while newer, low-mileage vehicles remained scarce—a trend expected to persist in 2025. Economic uncertainty, interest rates, and a […]

The 2024 White Metal Market Report (Q3) highlights a stable yet uncertain used vehicle market. While consumer spending remains strong despite inflation and high interest rates, economic uncertainty lingers, and any major disruption could push the market downward. Housing prices are rising, unemployment is slightly up, and a strong U.S. dollar is limiting international demand. […]

Fleet experts trust FLD to save time, money, and resources.