FLD’s quarterly Fleet Manager Sentiment Index scores how top fleet managers are feeling about 7 key topics important to the industry on a 1 (not feeling positive about a subject) to 5 basis (feeling confident). Tariff uncertainty. Budget cutting. EV back pedaling. The first half of 2025 has been a cauldron of disruptions, as fleets try to navigate yet another rough stretch just as it seemed the industry was settling into familiar patterns. That didn't go unnoticed by our panel of top fleet managers who report that while they're collective confidence in vehicle availability and the supply chain has increased minimally in Q2, their feelings on talent availability, maintenance and the US economy have taken a step back. Note that this quarter we add a new category - safety - due to its unquestioned importance to fleets everywhere. *Mouse over any quarter to see its specific chart.

Work Truck Week 2025 saw record attendance and exhibitors, affirming its status as the premier fleet industry event. Tariffs and regulatory uncertainty were major discussion points, while relationship-building took precedence over new tech. Electric vehicle (EV) momentum slowed amid infrastructure concerns, with alternative fuels like hydrogen and propane gaining interest. Major OEMs showcased electric offerings, […]

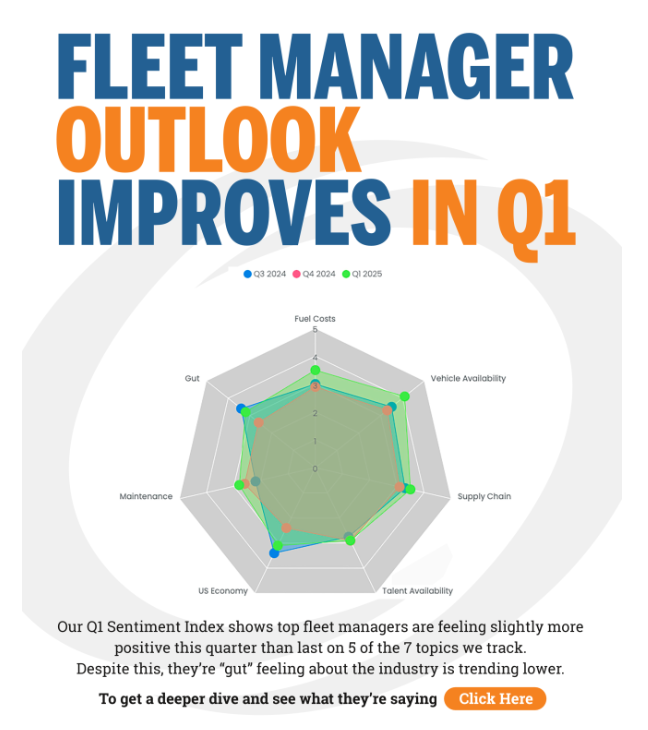

In Q1, fleet managers expressed slightly more confidence across most areas compared to Q4 2024. However, concerns remain. Supply chain disruptions—especially around semiconductors—persist, despite signs of resilience. Vehicle availability is improving, but upfit delays continue. Economic uncertainty, especially for small businesses, and geopolitical tensions are causing caution. Fuel price outlook is modestly optimistic. Overall, many […]

Fleet experts trust FLD to save time, money, and resources.