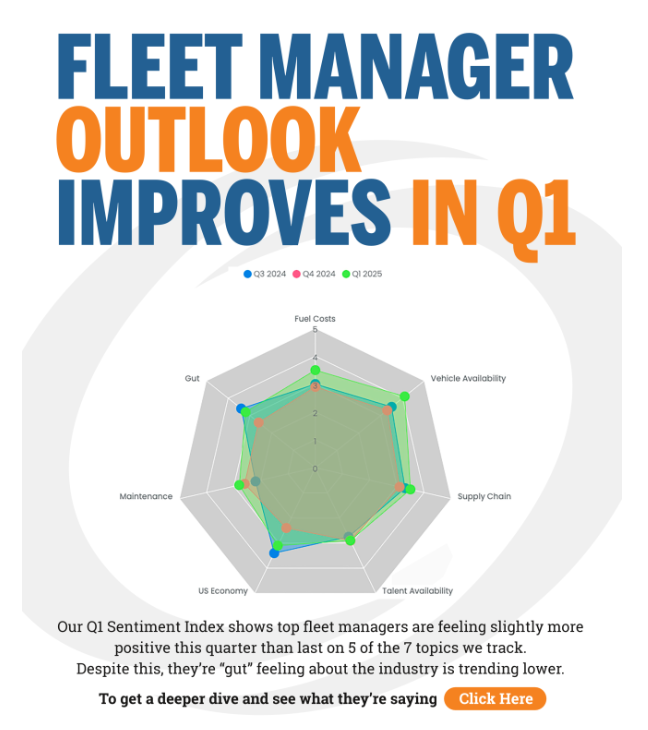

SAFETY, US ECONOMY TOP OF MIND. With the end of the year fast approaching our Q4 Fleet Manager Sentiment Index shows that while top fleet managers feel much the same about our basket of 7 key indicators, conversations with them are starting to expose some divergence in their thinking and concerns about some of the potentially more critical categories like safety and the US economy, with one of our customer advisors saying the economy “felt like 2008 all over” as tariffs and a long few years of high interest rates have stifled growth. Fleet managers also continue to be negative on talent availability – especially when it comes to drivers – as well as expressing concerns about vehicle service and maintenance, citing rising costs and increased repair times as especially concerning. *On a scale of 1-5 with 5 being most confident. Mouse over any quarter to see its specific chart.

No Data Found

Work Truck Week 2025 saw record attendance and exhibitors, affirming its status as the premier fleet industry event. Tariffs and regulatory uncertainty were major discussion points, while relationship-building took precedence over new tech. Electric vehicle (EV) momentum slowed amid infrastructure concerns, with alternative fuels like hydrogen and propane gaining interest. Major OEMs showcased electric offerings, […]

In Q1, fleet managers expressed slightly more confidence across most areas compared to Q4 2024. However, concerns remain. Supply chain disruptions—especially around semiconductors—persist, despite signs of resilience. Vehicle availability is improving, but upfit delays continue. Economic uncertainty, especially for small businesses, and geopolitical tensions are causing caution. Fuel price outlook is modestly optimistic. Overall, many […]

Fleet experts trust FLD to save time, money, and resources.